If you have credit card debt, please don’t fall into a funk, or think you can wait to tackle it in a few months. No, no, no!

Credit card debt is one of the most expensive financial mistakes you can make. The average interest rate is 15% and it can rise to nearly double that if you’re not careful. And credit card issuers love to lull you into making small payments, so they can just keep charging all that interest.

You need a plan of attack. It’s not really that hard, as long as you have the resolve to take control of your financial life. Here’s what you need to do:

- If you have a FICO credit score of at least 720, look into a balance transfer deal where you will owe zero interest for the first year or longer. You can find deals online. If you qualify for a zero-rate deal, and you are paying 10% or 15% interest on your existing credit cards, I think it is smart to move your high rate debt to the balance transfer deal. And then work like crazy to get the balance paid off before the card jumps from zero to 10% or higher. A zero-rate period is an incredible deal. You will likely have to pay a transfer fee of 3% or 4% of the amount you move, but if you manage to get the balance paid off, you are going to come out way ahead.

- If a balance transfer deal isn’t going to work for you, organize your credit card balances from the card that charges the highest interest rate, to the one that charges the least.

- You are to pay the minimum payment due on every card—on time!-except for the card with the highest interest rate.

- Write down the minimum payments you made on every card in this first month of your get-out-of-debt plan. You are going to pay at least those amounts every month. Even if the next statement has a lower minimum payment due, ignore it. Stick with what you paid in month 1; that’s your new permanent minimum.

- For the card with the highest interest rate, you must pay more than the minimum. How much more is up to you. Stand in your truth. This is about building a better life for you. If your initial thought was “I could pay $25 more than the minimum,” I challenge you to aim for double that amount. Don’t say you can’t, until you have tried. If you are determined, I am confident you can find ways to reduce your spending to free up more money.

- Once you have the balance paid off on the card with the highest interest rate, focus on the card with the next highest interest rate. Your monthly payments for this card should be the minimum payment you’ve been making plus the entire amount you were paying on the card you just paid off. So for example, let’s say you were paying $375 a month on your highest rate card. When you get that card paid off, take the entire $375 and apply it to the next card.

Once card #2 is paid off, focus on the next card with the highest interest rate. Just keep at this and you will be out of debt sooner than you ever imagined.

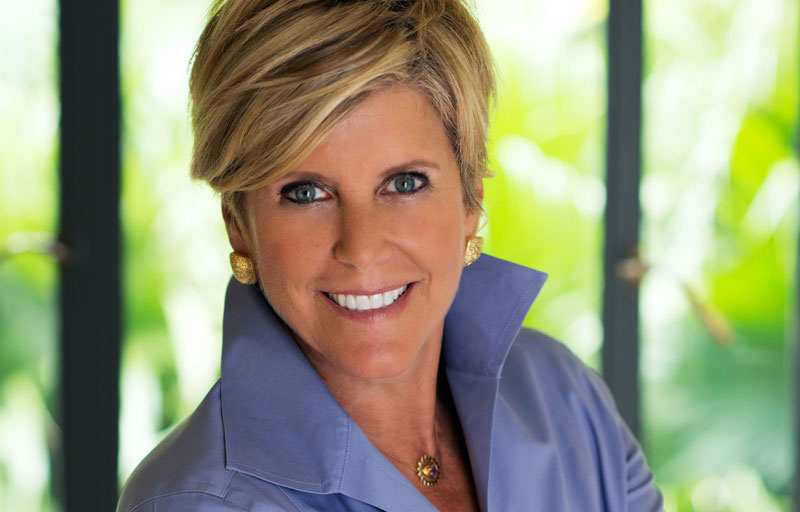

Suze Orman has been called “a force in the world of personal finance” and a “one-woman financial advice powerhouse” by USA Today. A two-time Emmy Award-winning television host, New York Times mega bestselling author, magazine and online columnist, writer/producer, and one of the top motivational speakers in the world today, Orman is undeniably America’s most recognized expert on personal finance. Visit Suze’s website, www.suzeorman.com, to access a wealth of resources that will help you to get smart about your money.

Dealing with Emergency Dental Bills – Tips from DentalPlans.com

Don’t let unexpected bills for essentials like dental emergencies derail your efforts to get out of debt, figure out how to manage them now. Below are some options to consider.

See how much you can save with a dental savings plan.

See how much you can save with a dental savings plan.

Use our calculator below >

Invest in Yourself with a Pre-Tax Health Savings Account

If you have a High Deductible Health Plan (HDHP) and meet other qualifications, you can set aside money (pre-tax) in a dedicated Health Savings Account (HSA) to pay for qualified medical expenses, including dental. HSA funds roll over year to year if you don’t spend them, and may earn interest.

Consider a Dental Savings Plan

Unlike traditional dental insurance, you can join a dental savings plan today and get discounts on virtually all dental treatments as soon as your plan activates (typically within 72 hours of purchase, and some plans activate within 24 hours). Plan members report saving an average of 50%* on their dental care,

There is a dental savings plan that fits every dental care need and budget. Want to know more? Just answer a few quick questions to see how much you can save on your dental care.

*Discount Health Program consumer and provider surveys indicate average savings of 50%. Savings may vary by provider, location, and plan.

Login

Login